Divorce can be overwhelming, and one of the most common questions people ask is about alimony—also called spousal support. In Illinois, alimony laws are designed to help ensure that one spouse isn’t left in financial hardship after a divorce, but the rules can be confusing.

If you want to understand alimony in Illinois in plain, simple language, this guide breaks it down step by step. No heavy legal jargon—just the information you need to know.

What Is Alimony in Illinois?

Alimony is financial support paid by one spouse to another after a divorce. The goal is to help the lower-earning or non-earning spouse maintain a standard of living similar to what they had during the marriage.

Alimony can cover:

- Living expenses

- Rent or mortgage payments

- Utilities and household bills

- Health insurance

- Education or job training

It’s important to know that alimony is separate from child support, which is specifically for children.

Types of Alimony in Illinois

Illinois recognizes several types of spousal support, including:

- Temporary or Maintenance During Divorce

- Paid while the divorce is ongoing

- Helps the lower-income spouse cover expenses until the court finalizes the divorce

- Rehabilitative Maintenance

- Most common type of alimony in Illinois

- Paid for a specific period to help the recipient become financially independent

- Often used for education, training, or job relocation

- Permanent Maintenance

- Rare and usually for long-term marriages

- Paid indefinitely if the recipient cannot become self-sufficient due to age, health, or other factors

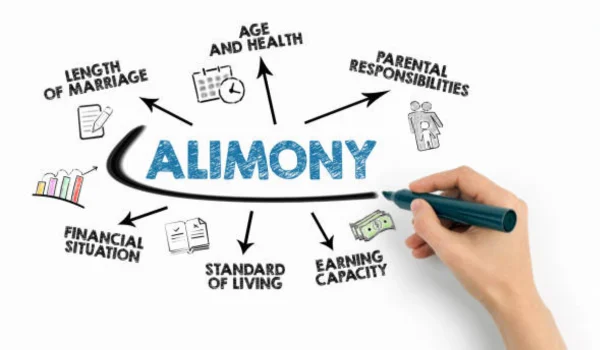

How Does Illinois Determine Alimony?

Illinois law gives judges flexibility. There’s no strict formula, but courts consider many factors:

- Length of the marriage – Longer marriages often result in longer alimony payments.

- Age and health of both spouses – Older or less healthy spouses may receive more support.

- Financial resources – Income, assets, and property of each spouse.

- Standard of living during marriage – Courts try to allow both spouses to maintain a similar lifestyle.

- Earning capacity – Education, job skills, and employment prospects of both spouses.

- Contributions to the marriage – Both financial and non-financial contributions (like homemaking or child care).

- Any agreements – Prenuptial or postnuptial agreements that mention alimony.

How Long Does Alimony Last in Illinois?

The duration depends on the length of the marriage:

- Less than 5 years – Maintenance usually lasts a short time or until the recipient becomes self-sufficient.

- 5–10 years – Maintenance may last up to 20–40% of the marriage length.

- 10–20 years – Maintenance may last 40–60% of the marriage length.

- 20+ years – Permanent maintenance may be considered, especially if the recipient cannot become financially independent.

Courts can modify or terminate alimony if circumstances change significantly.

How Much Alimony Will I Receive or Pay?

Illinois does not have a strict formula, but judges often use guidelines and discretion. Factors include:

- Income difference between spouses

- The ability of the paying spouse to provide support

- The recipient’s needs

The judge will try to make the amount fair and reasonable without causing undue hardship.

Can Alimony Be Changed or Terminated?

Yes. Alimony in Illinois is not always permanent. Modifications can happen if:

- The recipient’s financial situation improves

- The paying spouse loses income or becomes unemployed

- The recipient remarries or cohabitates with a new partner

- Health or living expenses change significantly

Courts can also terminate alimony if either party dies.

Taxes and Alimony in Illinois

It’s important to know how taxes work for alimony:

- For divorces finalized after December 31, 2018, alimony is no longer tax-deductible for the paying spouse

- The recipient does not report alimony as taxable income

This can affect how much is actually received and paid, so it’s worth planning ahead.

Agreements and Alimony

Many couples settle alimony through a divorce agreement instead of going to court.

- A written agreement can specify the amount, duration, and type of maintenance

- Courts usually approve agreements if they are fair and reasonable

- Having a lawyer review or draft the agreement is strongly recommended

Common Misunderstandings About Alimony in Illinois

Myth 1: Only women receive alimony

- Wrong. Either spouse can receive maintenance, depending on income and needs.

Myth 2: Alimony is permanent

- Usually not. Most alimony is temporary or rehabilitative.

Myth 3: Alimony is automatic

- Courts decide on a case-by-case basis. There’s no guarantee.

Myth 4: Alimony cannot be modified

- False. Significant changes in income or circumstances may allow modification.

How to Prepare for an Alimony Hearing

If you are seeking or contesting alimony:

- Gather financial documents – Income statements, tax returns, property records, debts

- Track living expenses – Helps show actual financial needs

- Document contributions to marriage – Both financial and non-financial

- Consider future earning potential – Education, job training, health, and age

- Work with a qualified family law attorney – Experienced guidance can improve your outcome

Final Thoughts

Alimony in Illinois is designed to support fairness and financial stability after divorce. While the rules allow flexibility, understanding the key factors—like duration, amount, and modification rights—can help you navigate the process confidently.

Whether you are paying or receiving alimony, knowing your rights and responsibilities is crucial to avoid surprises and ensure that financial support is fair and manageable.

Quick FAQs

Who can receive alimony in Illinois?

Either spouse can, depending on income, needs, and ability to support themselves.

How long does alimony last?

It depends on the marriage length and other factors; it can be temporary or permanent.

Can alimony be changed?

Yes, if there is a significant change in circumstances.

Is alimony taxable in Illinois?

For divorces after 2018, no—it’s no longer deductible for the payer and not taxable for the recipient.